Statutory Paternity Leave and Pay Changes Ahead - Guest Article by Ian Holloway

Employers and HR professionals need to be aware of changes to Statutory Paternity Leave effective 06 April 2024. This will affect existing processes plus policies and procedures. And, of course, professionals will need to ensure that any payroll/HR software is updated.

There is a long timeline to this change:

- In July 2019, a ‘Good Work Plan: Proposals to support families’ consultation proposed changes to the existing regime

- Later in 2019. the Conservative Party Manifesto committed a future Government led by them would look at ways ‘to make it easier for fathers to take paternity leave’

- In June 2023, the Conservative Party, now the UK Government, published its responses to the 2019 consultation indicating the changes

In summary, the changes do not change the underlying structure of Statutory Paternity Leave. This will still be 2 weeks and there will still be eligibility criteria. However, what is now a rigid regime (which may deter ‘fathers’ from taking it) will become a flexible regime.

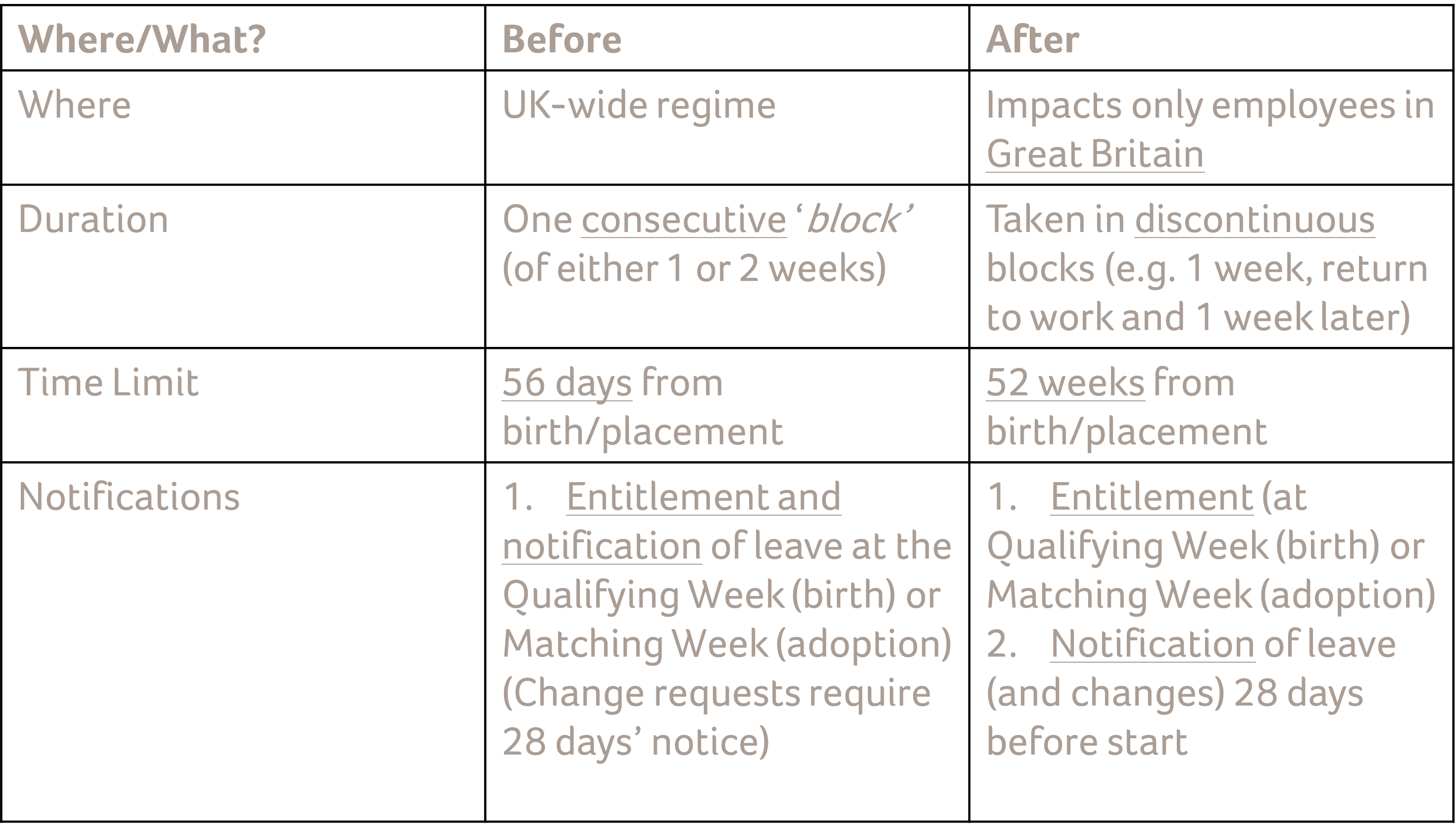

I outline the four main changes in a ‘before and after 06 April 2024’ table below, underlining the important words:

HMRC wrote to software developers on 10 August 2023 confirming that amending legislation will be in place by 08 March 2024. This date allows flexibility to start from 06 April 2024 (i.e. 08 March 2024 is 28 days ahead of 06 April 2024). They also confirmed changes will be made to HMRC Basic PAYE Tools, the eligibility checkers, calculators, guidance plus claim forms (SC3, SC4, and SC5) and dispute forms (SPP1 and SPP2).

Action for Employers

The wide definition of ‘father’ is not changing. As we know, this impacts many people. The rate of payment is not changing either, nor is the reclaim percentage (92% etc.).

‘All’ that is changing is outlined above:

- The rigid continuous block becomes flexible and can be taken in discontinuous blocks (of one week)

- 56 days becomes 52 weeks

- From 06 April 2024, the employee will have to provide 2 forms – a notification of entitlement and a notification of leave start dates

Plus, legislation will only amend the Employment Rights Act so will only apply to employees who have a contract written under this. Therefore, this excludes employees in Northern Ireland who may have a contract written under the Employment Rights (Northern Ireland) Order.

There are 4 key takeaways for employers:

- Update policies and procedures

- Consider aligning any occupational paternity schemes in line with the flexibilities coming with the statutory regime

- Check 2024/25 payroll and HR software releases, and

- Communicate (to colleagues, employees, managers etc)

Ian has been in the payroll profession for over 30 years, processing payrolls from all sectors, large and small. He moved from hands-on exposure in 2011 to becoming involved in educating the profession. His wide-ranging experience and up-to-date knowledge ensured he was able to impart this information to UK professionals through course material, social media, newsletters and face-to-face presentations.

Today Ian combines both these and is involved with a vital aspect of the payroll environment, that of working with the software that actually does a lot of the hard work for the profession.

Ian approaches education and communication very much from the perspective of how this will impact the software, the employer and the worker. So, whilst the legislation is vital, compliance and effective communication are paramount.

Connect with Ian on LinkedIn.